Expected Value is a great way to measure whether a bet is potentially profitable. In fact, one mathematician even used EV to guarantee multiple lottery jackpot wins. Despite its usefulness, however, many bettors are unfamiliar with the technique. Learn about measuring Expected Value in betting here.

Expected Value – or EV – is a method used to measure the relative values in a two-sided decision, like ‘will a coin land on heads or tails?’ It does this by using a simple decision matrix that weighs up the upside and downside of the two options.

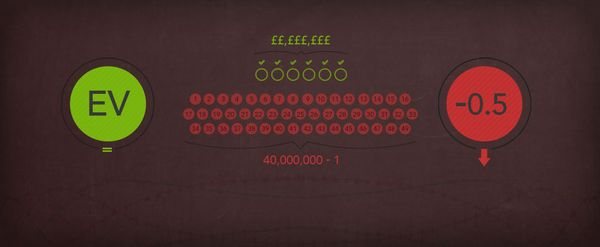

It’s best used by bettors to determine the amount they can expect to win or lose on a given bet – with a positive EV indicating a profitable proposition. The UK National Lottery, for example, has a negative EV of -0.50p – you theoretically lose 50p for every £1 invested – which means that it is a bad bet for making money.

How to Calculate Expected Value

The formula for calculating Expected Value is relatively easy. Multiply your probability of winning by the amount you could win per bet, and subtract the probability of losing multiplied by the amount you stand to lose per bet:

(Amount Won per Bet x Probability of Winning) – (Amount Lost per Bet x Probability of Losing)

The easiest betting example is a fair coin toss, in which there are two choices. Imagine you bet £10 on the two outcomes, which both pay out at the same rate (probability of 0.5 or 2.0 in Decimal odds). This produces a decision matrix that has an EV of 0 for either outcome. This is because the probability of the two outcomes is the same, so if you tossed a coin forever you would theoretically just end up all square.

If, however, we change the return on Heads to pay £11 – so a probability of 0.48 or odds of 2.10 – this changes the matrix, and produces a positive EV of 50p for backing Heads. This means that if you were to make the same bet on Heads over and over again, you can expect to profit an average of 50p for each bet of £10, because the odds received are better than the implied odds of the event.

| Choice: | Calculation (Heads – Tails): | EV |

|---|---|---|

| Heads | (£10 x 0.5) – (£10 x 0.5) | 0 |

| Tails | (£10 x 0.5) – (£10 x 0.5) | 0 |

| Choice: | Calculation (Heads – Tails): | EV |

|---|---|---|

| Heads | (£11 x 0.5) – (£10 x 0.5) | £0.50 |

| Tails | (£10 x 0.5) – (£10 x 0.5) | 0 |

You should bite the hand off anyone offering you that opportunity, because in the long run you will not lose. And it is important to stress it is in the long run, because EV is theoretical.

Winning the lottery with EV

EV originated way back in the 17th Century after a discussion between a trio of eminent mathematicians about payouts for dice games. One of them, Blaise Pascal – later to become famous for his work on binomial expansions (Pascal’s Triangle) – was the first to use the idea of Expected Value, as he struggled with a much weightier quandary – the existence of God.

Many years later, a Romanian mathematician, Stefan Mandel, understood only too well how the EV for lotteries worked, and used his knowledge to take advantage of circumstances when lotteries can actually be a good bet.

The UK National Lottery has a negative EV of 50p for every £1 staked

To win the National Lottery, you need to match six numbers drawn from 1 to 49, of which there are 14 million possible combinations, meaning the chance of winning is 14million to one. Therefore in order for this to be a profitable bet, the return – the jackpot – would have to be greater than the odds, but lotteries tend to function as a risk-free method for governments to generate treasury funds, so the odds normally outweigh the return as stated above.

A ranking of common gambling activities from bingo to blackjack (in terms of EV) would have large lotteries at the bottom. The UK National Lottery as an example has a negative EV of 50p for every £1 staked (so -0.50p). This is why it is derided as an indirect form of taxation.

There is however, an exception to the standard EV for lotteries. When a winning ticket isn’t sold for a given draw, the jackpot rolls over and is combined with the jackpot from the next draw. When a jackpot rolls over enough times, it can rise to a point where the EV becomes positive. Mandel understood this and set about finding a way to exploit it.

The theory was simple. Wait for a big enough rollover, and then cover all the possible permutations. The practical implications enormous – he needed to buy tickets to cover all the permutations – that is long time at the local convenience store. Despite the extent of the challenge he succeeded in that monumental task (on a number of occasions). His outlay was less than the jackpot, which having bought tickets for every possible combination of numbers, he scooped (notably benefiting from a lack of shared winners).

The principle of exploiting specific situations of positive EV is at work when card counters try to get the better of casinos at the blackjack table, focusing on fleeting situations when the make up of the deck gives the player a potential edge over the house.

Buying 14 million lottery tickets, or learning to count cards are both beyond the means of the average bettor, but there are two situations when positive EV is a realistic objective. Arbitrage & Niche Market Handicapping.

Arbitrage & Positive EV

Arbitrage is the explicit exploitation of odds from separate bookmakers which when brought together to form an artificial market provide a positive EV.

Arbitrage is an increasingly popular form of betting, having been the successful and legitimate basis of financial trading for many decades. Arbitrage is not a flakey system – the mathematical logic is irrefutable. The issue lies with the reluctance of many bookmakers to accommodate arbitrage players, which is where Pinnacle Sports stands out, operating an arbitrage welcome policy.

Implied EV

Whereas arbitrage trading exploits explicit situations of positive EV – the opportunities are concrete if fleeting – there are also situations where the positive value can be implied, emanating from a variation in opinion. Serious bettors build their own handicapping systems, and therefore generate their own opinion of a given market. When the odds that their system generates differ widely with what a bookmaker is offering, they perceive positive EV – based on their assessment.

This is likely in niche markets, when the playing field between bookmakers and independent bettors is more even. This can produce a decision matrix in which you are receiving odds that are better than those implied by the bet, and therefore in the long run the wager would give you a profit.

A brilliant mathematician wrestling with the biggest question of all may have created EV, but it is actually better suited for more humble means. It is an excellent tool for bettors to establish how profitable a bet might be. If you haven’t been using it, there is no need to resort to a decision matrix to reason why.

MORE: TOP 100 Online Bookmakers >>>

MORE: TOP 20 Cryptocurrency Sportsbooks >>>

MORE: Best E-Sports Betting Sites >>>

Source: pinnacle.com